Aerospace Manufacturer Venture Capital - Q2 2024

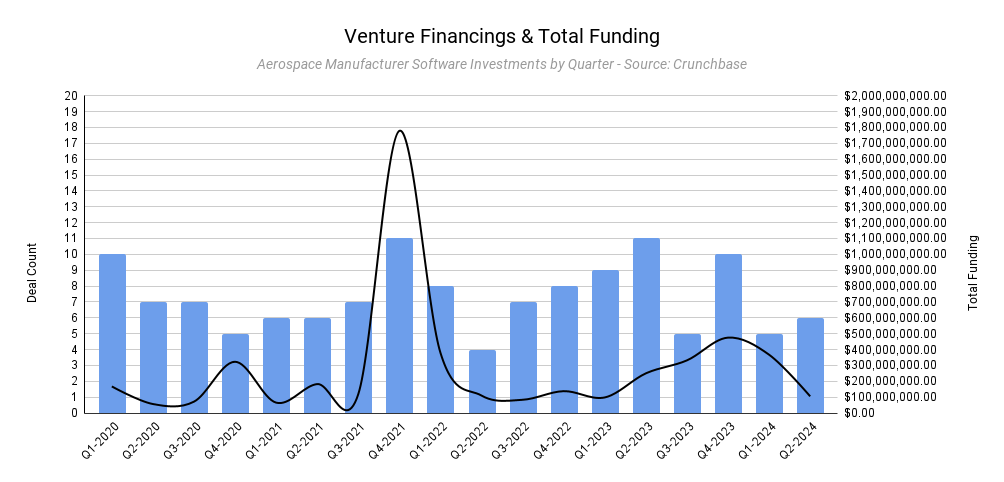

Blue: Deal Count (LHS) | Black: Total Financing Volume (RHS)

Aerospace Manufacturer Venture Capital - Q2 2024 Investment Update

April – June 2024

Executive Summary

The Aerospace Manufacturer Venture Capital sector saw a total of 6 financings close in Q2 2024, totaling $105 million USD. The quarter represented a 20% increase in the number of deals compared to Q1 2024, but there was a sharp 71.42% decrease in total funding value compared to the same period in the previous year. This also marked a 45.45% decline in deal count and a 57.98% drop in financing volume compared to Q2 2023.

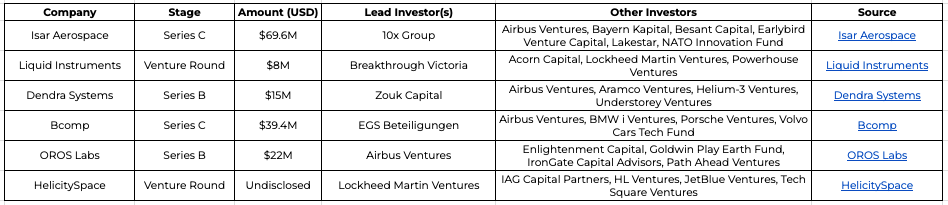

The largest deal of the quarter was Isar Aerospace's Series C round, raising €65 million ($69.6 million USD) to fuel the advancement of small satellite launch vehicle technology. Other key deals in the quarter included Liquid Instruments' venture round and Dendra Systems' Series B. Airbus Ventures and Lockheed Martin Ventures remained active players throughout the period, participating in multiple funding rounds.

Key Deals in Q2 2024

Isar Aerospace: Raised €65 million ($69.6 million USD) in Series C funding to advance the development of its small satellite launch vehicles.

Liquid Instruments: Closed a venture round worth AUD 12 million ($8 million USD) to develop advanced test and measurement instruments for the aerospace and defense sectors.

Dendra Systems: Raised $15 million in a Series B round to develop its AI-driven ecosystem restoration technologies, which have applications in sustainability and defense sectors.

Bcomp: Secured CHF 36 million ($39.4 million USD) in Series C funding to expand its sustainable composite material solutions in aerospace and automotive industries.

OROS Labs: Raised $22 million in Series B funding to advance its high-performance thermal materials for extreme environments, with participation from Airbus Ventures.

HelicitySpace: Closed a venture round (undisclosed) to advance its space launch technology with participation from Lockheed Martin Ventures and other aerospace-focused investors.

Q2 2024 Performance

Total Deals: 6

Total Financing: $105 million USD

Quarter-over-Quarter Deal Count: +20%

Year-over-Year Deal Count: -45.45%

Year-over-Year Financing Volume: -57.98%

Analysis

Q2 2024 saw a noticeable drop in the total financing volume year-over-year, reflecting the current market’s caution around high-risk aerospace ventures, especially in early-stage investments. Despite this, a few significant deals, such as Isar Aerospace’s Series C and Bcomp’s Series C, underscore the industry’s continued focus on advanced propulsion systems and sustainable materials for aerospace.

The involvement of major venture players such as Airbus Ventures and Lockheed Martin Ventures in multiple rounds highlights their ongoing commitment to fostering innovation in both space exploration and sustainable aerospace technologies.

Given the shift in deal volume and funding, the focus is clearly shifting towards mature and commercially viable technologies, with late-stage ventures drawing the bulk of investment.

Disclaimer: This post is provided for informational purposes only and is not intended to be used as a basis for investment decisions. While the data and analysis in this report are drawn from sources believed to be reliable, accuracy and completeness cannot be guaranteed. The opinions and views expressed in this document are those of the authors and do not necessarily reflect the official policy or position of any other agency, organization, employer, or company. This document is not a substitute for professional advice. Before making any investment, we recommend consulting with a qualified professional advisor who understands your specific needs and circumstances. All investments involve risks, including the potential loss of principal.